© 2024 ADUSearch. All rights reserved.

Denser, more urban cities are not only more environmentally friendly but also more efficient and less expensive to run. As the saying goes – only two things are true in life: death and taxes.

Property owners that have an additional dwelling unit (ADU) do have to pay taxes on that unit. The amount is driven by the assessed value of the ADU. Naturally, this value changes depending on the size, type, quality, and finishings of the ADUs. As some ADUs can reach the size of a small single-family home, the tax impact can be proportional to that scale in many cases.

Our tax revenue models assume a standardized detached ADU (specifically 40 sq. m/431 sq. ft) as the baseline for our tax calculations. The structure is also assumed to be a one bedroom/one bath unit, built on a concrete pad, not taller than the main dwelling, with separate utility hookups, standard finishing, and a single parking space.

We shared this sample structure with tax assessment agencies across the country and determined that the annual average property tax for our model ADU in the cities we have processed is approximately $680. That doesn’t sound like much, but given that most cities that allow ADUs have the potential to enable thousands of units, the impacts could be significant.

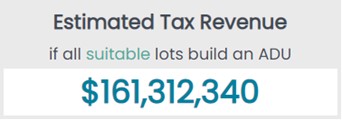

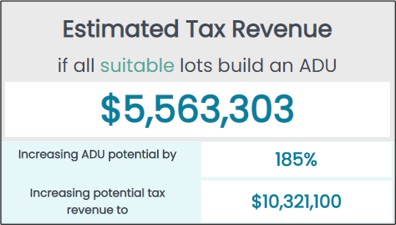

On each municipal homepage, we provide the “Estimated tax Revenue”, which shows the maximum revenue potential. This estimate assumes a scenario where all suitable lots in the municipality are built and then projects the total revenue from this value. As you would suspect, Toronto has the greatest tax revenue potential with over $161 million, while the City of Brantford with a population of about 102,159 has an increased revenue potential of about $5.6 million.

The National Minimum Regulation (or, the “NMR”) expands ADU potential by applying less restrictive bylaws to lots which, in turn, increases revenue potential. Brantford revenue potential grows to over $10.3 million if all suitable lots in an NMR scenario built ADUs.

It is unlikely that every lot will build an ADU, but if 5% or 10% of the lots do build these units, it is still on the smallest scale, hundreds of thousands, if not millions of dollars for municipalities. This revenue could be used to off-set financial incentives that encourage this type of gentle infill development. Many cities already offer financial incentives as can be seen in the initial listing in our Resource Centre.

If you want to read more about our tax revenue methodology, you can find a report on our Data Exports portal.